|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Discovering Better Mortgage Refinance Rates: Essential Tips and StrategiesUnderstanding the Basics of Mortgage RefinancingRefinancing your mortgage can be a smart financial move, but understanding how to secure the best rates is crucial. Whether you're looking to lower your monthly payments or take advantage of lower interest rates, knowing the basics will help you make informed decisions. Why Refinance?Homeowners typically refinance to achieve better mortgage terms or to access home equity. Lower interest rates can significantly reduce your monthly payments and overall loan cost. Types of Refinance

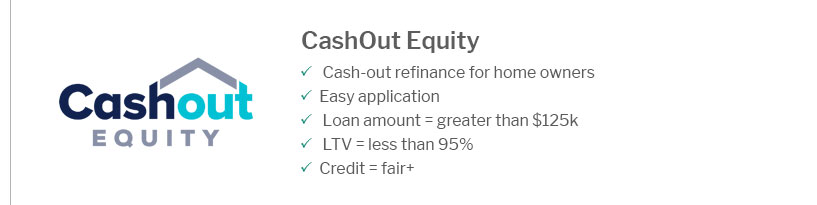

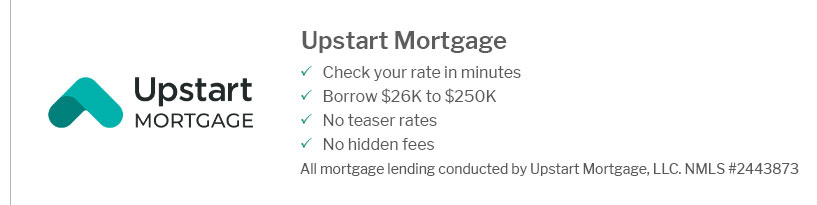

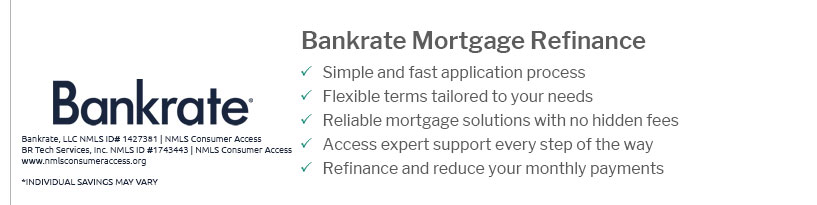

Factors Influencing Refinance RatesSeveral factors impact the refinance rates you might be offered. Here’s what to consider: Credit ScoreYour credit score is a key determinant of the rate you qualify for. Higher scores often mean better rates. For those with lower scores, low credit FHA lenders may offer alternative options. Loan-to-Value RatioThe amount of equity in your home, expressed as a loan-to-value (LTV) ratio, affects your refinance rate. More equity can lead to better rates. Current Market ConditionsInterest rates fluctuate based on economic conditions. Keeping an eye on market trends can help you refinance at an opportune time. Strategies for Securing Better RatesImplementing strategic measures can enhance your refinance experience. Improve Your CreditBefore applying, work on boosting your credit score. Pay down debts and ensure timely bill payments. Shop AroundDon't settle for the first offer. Compare rates from multiple lenders to ensure you get the best deal. Consider specialty programs like home loans for EMTs if applicable. Negotiate FeesMany lenders are willing to negotiate closing costs and other fees. Be prepared to ask for discounts or credits. Frequently Asked QuestionsWhat is the best time to refinance my mortgage?The best time to refinance is when interest rates are lower than your current rate, and you plan to stay in your home long enough to recoup closing costs. How can I calculate my break-even point?Divide the total closing costs by the monthly savings from the new loan. This will tell you how many months it will take to break even on the refinance. Are there any risks associated with refinancing?Yes, refinancing resets your loan term, which can increase total interest paid over the life of the loan. Make sure the benefits outweigh the costs. https://better.com/cash-out-refinance-rates

Here are today's cash-out refinance rates in . Take the next step by getting a personalized quote in as quick as 3 minutes with no impact to your credit score. https://better.com/refinance-rates

Refinance rates today. Here are today's refinance rates in . Get a personalized quote for your area in as little as 3 minutes, with no impact to your credit ... https://better.com/mortgage-rates

At Better Mortgage, we believe in letting you keep as much money in your pocket as possible, so we never ...

|

|---|